Statutory Corporate Valuation

ZAC helps insurance companies to value their assets and liabilities in accordance with statutory requirements. This information is used to calculate the company's solvency and to ensure that it is able to meet its financial obligations to its customers.

Actuarial Research of Relevant Sectors

We conduct research on the Life and Funeral Assurance industry to identify trends and risks. This information can be used to develop new products and services, to improve existing products and services, and to manage risk.

Reinsurance Arrangement Recommendations

ZAC helps insurance companies to select and negotiate reinsurance arrangements. Reinsurance is the practice of transferring some of the risk associated with an insurance policy to another insurer. This can help insurance companies to reduce their exposure to risk and to improve their financial stability.

Product Design and Development

ZAC helps insurance companies to design and develop new products that are both profitable and meet the needs of customers. We can also help to assess the risks associated with new products and to ensure that they are priced appropriately.

Profitability Analysis

ZAC helps insurance companies to analyse their profitability by reviewing their financial statements and identifying areas where costs can be reduced, or revenue can be increased. This information can be used to improve the company's financial performance.

Advise on Underwriting

ZAC provides advice to insurance companies on underwriting decisions. Underwriting is the process of assessing the risk associated with an insurance applicant and deciding whether to accept the risk. We help insurance companies to make informed underwriting decisions by providing them with information on the applicant's risk profile.

Experience Investigation (mortality/lapse/ expense analysis)

We can investigate the experience of an insurance company to identify trends and risks. This information can be used to improve the company's products and services, to manage risk, and to comply with regulations.

Advise on Capital Management

ZAC helps financial institutions to manage their capital by assessing the risks they face and by developing strategies to mitigate those risks. This can help to ensure that the financial institutions have sufficient capital to meet their obligations and to remain solvent.

Risk Identification

ZAC helps financial institutions to identify the risks they face by conducting risk assessments. This involves identifying the potential sources of risk, assessing the likelihood and impact of those risks, and developing strategies to mitigate them.

Reinsurance Arrangement Recommendations

ZAC helps insurance companies to select and negotiate reinsurance arrangements. Reinsurance is the practice of transferring some of the risk associated with an insurance policy to another insurer. This can help insurance companies to reduce their exposure to risk and to improve their financial stability.

Risk Analysis

We can help financial institutions to analyse the risks they face by using statistical and mathematical models. This can help to quantify the risks and to identify the most important risks to focus on.

Risk Mitigation

We can help financial institutions to mitigate the risks they face by developing and implementing risk mitigation strategies. This can involve using hedging strategies, diversifying investments, and managing liquidity.

Risk Monitoring

ZAC helps financial institutions to monitor the risks they face by tracking the performance of their risk mitigation strategies and by identifying new risks that may arise.

Investment Strategy Recommendations

ZAC helps financial institutions to develop investment strategies by assessing the risks and returns of different investment options. This can help to ensure that the financial institutions' investments are aligned with their risk appetite and their investment objectives.

Performance Measurement

ZAC helps financial institutions to measure the performance of their investments by tracking the returns of their investments and by comparing those returns to benchmarks. This can help to ensure that the financial institutions' investments are performing as expected.

Advise on Mergers and Acquisitions

We help financial institutions to assess the risks and benefits of mergers and acquisitions. This can involve using financial modelling to estimate the value of the target company and to assess the impact of the merger or acquisition on the financial institution's risk profile.

Product design

ZAC helps insurance companies to design health and general insurance products that are both profitable and meet the needs of customers. We can use their knowledge of statistics, mathematics, and risk management to assess the risks associated with different products and to ensure that they are priced appropriately.

Premium rating

ZAC helps insurance companies to set premiums for health and general insurance products. We use statistical and mathematical models to estimate the cost of claims, and then use this information to set premiums that are both profitable and fair to customers.

Claim reserving

We help insurance companies to estimate the cost of future claims. This is important because insurance companies need to set aside reserves to cover the cost of claims that have not yet been paid. We use statistical and mathematical models to estimate the cost of future claims, and then use this information to set reserves that are both adequate and prudent.

Claim experience investigation

ZAC investigates the experience of an insurance company to identify trends and risks. This information can be used to improve the company's products and services, to manage risk, and to comply with regulations.

Advice on Scheme Rules

ZAC provides advice on the design and operation of pension schemes. This includes advising on the eligibility requirements for membership, the benefits that will be provided, and the funding arrangements.

Conversion Valuations

We calculate the value of a pension scheme when it is converted from one type of scheme to another. This is important for employers who are considering transferring their pension scheme to another provider.

Retrenchment Benefit Calculations

ZAC calculates the retrenchment benefits that are due to employees who are being made redundant. This is important for employers who are making employees redundant and who need to calculate the cost of the retrenchment benefits.

Group Life Ratings

ZAC calculates the premiums that are required to insure the lives of employees under a group life insurance scheme. This is important for employers who want to ensure that their employees are covered in the event of death or serious illness.

Bulk Transfer Valuation

We calculate the value of a pension scheme when it is transferred to another provider. This is important for employers who are considering transferring their pension scheme to another provider.

Design of Pension Schemes

ZAC helps employers to design pension schemes that meet the needs of their employees and that are compliant with the relevant regulations.

Statutory Valuations of Pension Schemes

ZAC carries out statutory valuations of pension schemes. This is a legal requirement for most pension schemes and involves calculating the value of the scheme's assets and liabilities.

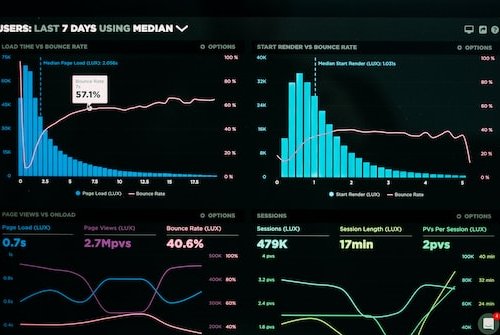

Business Insights

ZAC helps organizations to gain insights into their business by using data analytics to identify trends, patterns, and relationships. This information can be used to make better decisions about pricing, product development, and marketing.

Trend Analysis

ZAC helps organizations to track trends in their industry by using data analytics to identify changes in customer behaviour, market conditions, and regulatory requirements. This information can be used to stay ahead of the competition and to make informed decisions about the future.

Performance Optimization

We help organizations to optimize their performance by using data analytics to identify areas where costs can be reduced, or revenue can be increased. This information can be used to make improvements to processes, products, and services.

Loss of earnings claim calculations and reports

ZAC helps to calculate the amount of loss of earnings that a claimant has suffered as a result of an accident. This includes assessing the claimant's pre-accident earnings, the amount of time they have been unable to work, and the likely impact of the accident on their future earnings.

Loss of support calculations

ZAC helps to calculate the amount of loss of support that a claimant's dependents have suffered as a result of the death of the claimant. This includes assessing the dependents' financial needs, the amount of support that the claimant was providing, and the likely impact of the death on the dependents' future financial security.

Motor Vehicle Accident (MVA) calculations and reports

We help to calculate the amount of damages that a claimant has suffered as a result of a motor vehicle accident. This includes assessing the claimant's medical expenses, lost earnings, pain and suffering, and loss of future earning capacity.

Implementation

ZAC helps organizations to implement IFRS 17 by providing guidance on the requirements of the standard and by developing implementation plans. This can help organizations to comply with the standard and to avoid costly mistakes.

Reporting

ZAC helps organizations to report on their IFRS 17 liabilities by developing reporting frameworks and by providing training to staff. This can help organizations to meet the reporting requirements of the standard and to provide stakeholders with clear and accurate information.

Some of our clients